Lower income tax rates through a personal trust

This book walks you through the entire process of setting up a personal, tax-reducing trust — without spending $5,000–$7,000 on lawyers.

By receiving income as a beneficiary of the trust, your tax rate can be reduced by up to 30% (or more, depending on your situation).

Secure assets through an extra layer of legal protection

When you place your assets into a trust, you’re transferring ownership from yourself to a legal entity — the trust itself.

By legally separating your assets from your personal name, the trust adds a powerful layer of legal protection, ensuring your money and property remain secure, private, and protected for you and your family

Skip probate to avoid expensive legal fees

When your assets are held in a trust, they don’t go through probate — the lengthy and expensive court process used to distribute estates after death.

Instead, your trust allows assets to transfer privately and immediately to your chosen beneficiaries.

By avoiding probate, you save time, money, and legal fees, while keeping your estate confidential and under your family’s control.

|

others | |

|---|---|---|

| Step-by-step instructions in plain language | ||

| Legally reduces income and estate taxes | ||

| Avoids probate and expensive legal fees | ||

| No costly lawyers required | ||

| 30-day money-back guarantee |

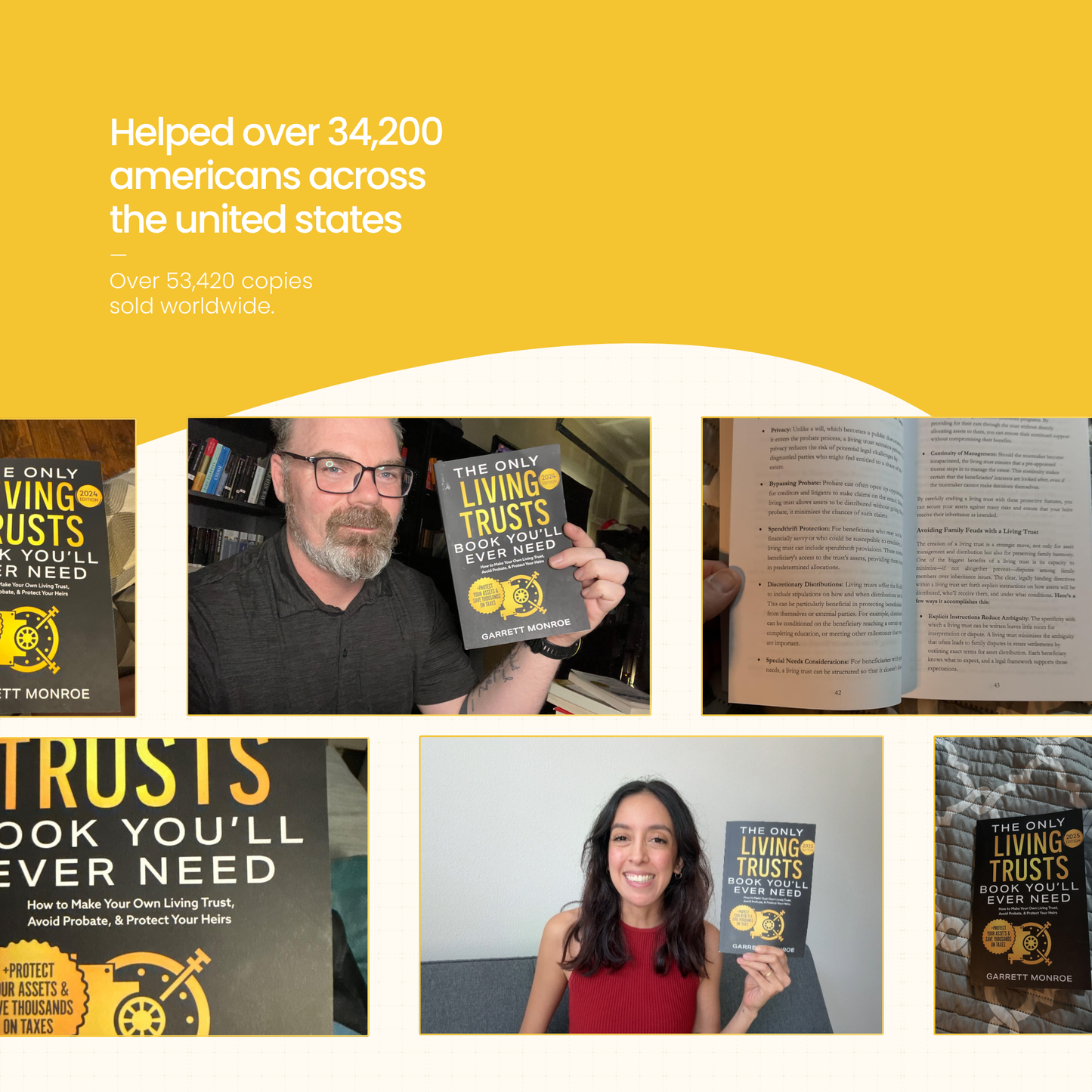

– OVER +53,420 COPIES SOLD WORLDWIDE –

FREQUENTLY ASKED QUESTIONS

Collapsible content

Do I need any legal experience to use this book?

Do I need any legal experience to use this book?

Not at all. The book is written in plain, easy-to-understand language with simple explanations and real examples. Anyone can follow the steps — even if you’ve never dealt with legal or financial documents before.

Will this book help me avoid probate?

Will this book help me avoid probate?

Yes! It clearly explains how personal trusts work and guides you through setting one up correctly, so your assets transfer smoothly without going through probate court.

Does it include templates or forms?

Does it include templates or forms?

Yes. You’ll find practical templates, examples, and checklists you can use immediately to start setting up your own personal trust.

Is this only for people with large estates?

Is this only for people with large estates?

No. Personal trusts are useful for anyone who wants to protect their assets — big or small. The steps in this book apply to both simple and complex situations.

Will this help me save on taxes?

Will this help me save on taxes?

Yes. The book explains how to legally structure your trust so that income is distributed at lower tax rates — helping you keep more of what you earn.

What if I’m not satisfied with the book?

What if I’m not satisfied with the book?

No problem. We offer a 30-day money-back guarantee. If you’re not completely happy, just contact us for a full refund — no questions asked.

How long does shipping take

How long does shipping take

Worldwide insured shipping typically takes 5–12 business days. You’ll receive a tracking number as soon as your order ships.

need help?

If you're not 100% satisfied with your order, we'll issue a full refund right away.

Just contact us at support@amenosa.com, and we'll be more than happy to help you.